Chinese LLMs vs Western LLMs - Developments, Comparisons, and Global Outlook

China’s LLMs are evolving fast, challenging Western dominance with AI breakthroughs, low-cost models & strategic funding. Who will lead?

China’s artificial intelligence industry is undergoing a seismic shift, with domestic tech giants and startups racing to develop the next generation of large language models (LLMs) and small language models (SLMs). Companies like Baidu, Alibaba, Tencent, and rising stars such as DeepSeek and Zhipu AI are pushing the boundaries of AI performance, integrating cutting-edge multimodal capabilities, and aggressively pricing their models to compete on a global scale.

As U.S. sanctions limit access to advanced semiconductor technology, China is accelerating innovation in AI efficiency, model distillation, and retrieval-augmented generation to offset hardware constraints. The result? A rapidly evolving ecosystem of bilingual and industry-specific AI models that are reshaping how businesses and consumers interact with artificial intelligence. With government-backed funding and a highly competitive pricing strategy, China’s AI landscape is poised to challenge Western dominance in the field.

But how do these models compare to their Western counterparts, and what are the larger geopolitical and economic implications of China’s AI surge? Let’s dive into the latest developments shaping the future of AI in China.

Recent Chinese LLMs and SLMs

Today’s Chinese AI landscape features a mix of tech giant LLMs and innovative startup models. Below we highlight some of the most prominent:

Baidu – ERNIE Family: Baidu’s ERNIE (Enhanced Representation through Knowledge Integration) series has become a dominant force in Chinese AI. ERNIE 4.0, launched in October 2023, introduced multimodal capabilities, long-memory handling, and enhanced performance in Chinese NLP. Baidu claims it rivals GPT-4, although independent analysis suggests only incremental improvements. The release of ERNIE 4.0 Turbo in 2024, rumored to surpass 10 trillion parameters through sparse activation, further cements Baidu’s commitment to AI leadership.

Alibaba – Tongyi Qianwen and Qwen: Alibaba entered the LLM race via its cloud division with the Tongyi Qianwen model, later rebranded as Qwen. By 2024, Alibaba open-sourced Qwen-7B and Qwen-14B, while its proprietary Qwen-2 72B model set new performance records, winning numerous AI competitions. With deep integration into Alibaba’s enterprise software, e-commerce, and cloud platforms, Qwen models have gained widespread adoption in China’s business ecosystem.

Tencent – Hunyuan: Tencent launched Hunyuan in 2023, leveraging its ecosystem spanning social media, gaming, and finance. Though details remain scarce, Tencent claims its model matches OpenAI’s offerings in select applications. By mid-2024, Tencent aggressively cut API pricing, making Hunyuan one of the most accessible LLMs. Speculated to be a 100B+ parameter model, Hunyuan’s multimodal upgrade is anticipated but not yet publicly documented.

iFlytek – Spark Desk (Xinghuo): Known for its speech technology, iFlytek’s Spark LLM has rapidly evolved, with Spark 3.5 making headlines in early 2024 for reportedly outperforming GPT-4 Turbo in Chinese language tasks, coding, and math. Spark’s strength lies in its advanced text-to-speech and speech-to-text integration, making it a leader in voice-assisted AI. Spark v4.0, launched in late 2024, improved emotional tone generation and multilingual capabilities, reinforcing iFlytek’s edge in voice AI.

SenseTime – SenseNova: SenseTime, initially a leader in computer vision, expanded into LLMs with SenseNova. SenseNova 5.0, introduced in April 2024, employs a hybrid Transformer-RNN architecture with a 200,000-token context window and a Mixture-of-Experts approach for computational efficiency. Positioned as a competitor to GPT-4, SenseNova claims state-of-the-art reasoning and coding performance, though external validation remains limited.

Zhipu AI – GLM Series: Zhipu AI, a spin-off from Tsinghua University, developed the GLM series, with GLM-130B gaining popularity as an open-source bilingual model. GLM-4-Plus, the latest iteration, leverages synthetic data for efficient training and purportedly matches GPT-4 in performance. Zhipu’s advancements have drawn regulatory scrutiny, with the U.S. government restricting its access to American technology due to national security concerns.

DeepSeek – DeepSeek R1: Emerging as a disruptive force, DeepSeek’s R1 model, introduced in 2025, demonstrated unprecedented efficiency by achieving GPT-4 Turbo-level performance at a fraction of the computational cost. Using advanced reasoning optimizations, chain-of-thought training, and ultra-efficient reward models, DeepSeek has set a new benchmark for cost-effective AI development. It has also open-sourced smaller distilled models, making high-performance AI widely accessible.

ModelBest – MiniCPM Series: Focused on small language models (SLMs), ModelBest’s MiniCPM series delivers real-time AI processing on edge devices. MiniCPM 3.0 (4B parameters) matches GPT-3.5-level performance while running on smartphones and embedded systems. By prioritizing local computation for privacy and cost efficiency, ModelBest is carving out a niche in on-device AI.

In summary, China’s latest LLMs range from massive, general-purpose models rivaling GPT-4 to small, efficient models optimized for deployment constraints. Many are bilingual (Chinese-English) and increasingly multimodal, handling text, images, and speech. The rapid iteration and diversity of approaches (open-source releases, corporate APIs, specialized models) indicate a vibrant environment.

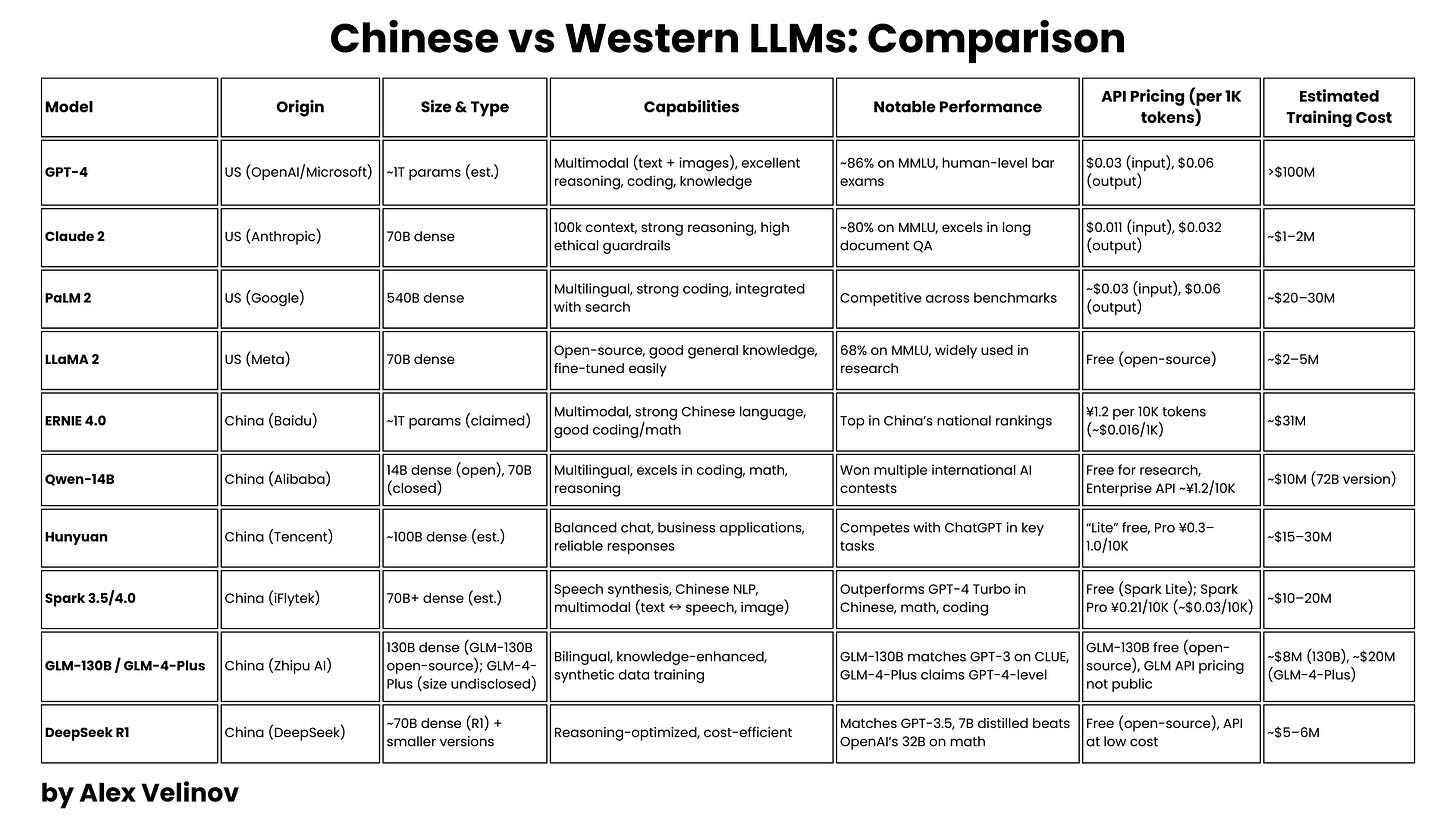

Chinese vs Western LLMs: Comparison

To understand how Chinese models stack up against Western ones, the table below compares representative LLMs from each side on pricing, performance, capabilities, and training costs. Models are selected to highlight top-tier offerings and notable innovations as of 2024–2025:

Economic Factors and Market Dynamics

China’s AI industry is projected to reach ¥118B (~$17B) by 2028, driven by significant investment from both the government and private sectors. The domestic demand for AI-driven automation and analytics is expanding rapidly, making China one of the largest markets for AI adoption. As Chinese firms compete for dominance, companies such as Tencent, Baidu, and iFlytek have aggressively lowered API prices, significantly undercutting Western competitors.

This pricing war has made AI more accessible to small businesses and developers, fostering a dynamic ecosystem where companies can experiment with LLM applications without the high costs associated with Western models. Additionally, many AI startups in China receive state-backed funding, allowing them to operate at lower margins while scaling their capabilities. This economic strategy ensures rapid AI adoption but raises sustainability concerns regarding long-term profitability.

Geopolitical Factors Shaping AI Competition

The geopolitical rivalry between China and the U.S. is reshaping AI development strategies. With AI being seen as a strategic asset, both nations are investing heavily to secure technological leadership. U.S. sanctions on high-end semiconductor exports, including Nvidia’s advanced GPUs, have forced China to accelerate domestic chip manufacturing and explore alternative computing solutions.

China’s regulatory environment also significantly impacts LLMs, as models must align with government content controls and censorship policies. This has led to the development of uniquely Chinese AI applications that integrate seamlessly with government regulations. Meanwhile, Western AI models benefit from fewer restrictions but face growing concerns over ethical AI governance and misinformation management.

Technological Factors and Future Outlook

Chinese AI companies are innovating to compensate for hardware limitations by improving computational efficiency. Techniques such as model distillation, retrieval-augmented generation, and sparse activation mechanisms are helping smaller models achieve high performance while requiring fewer resources. DeepSeek R1’s cost-efficient reasoning capabilities exemplify this approach.

Data quality remains a challenge due to censorship regulations limiting training data diversity. However, Chinese models excel in Chinese-language processing and domain-specific applications. As AI moves towards multimodal and agent-based models, both Chinese and Western companies are likely to develop specialized architectures that address their respective market needs.

Final Words

China’s AI evolution is more than just a race to build bigger and better models—it’s a strategic play for global technological leadership. The country’s AI firms are leveraging state-backed investments, aggressive pricing strategies, and computational efficiency breakthroughs to scale AI adoption at an unprecedented rate. While Western AI companies focus on open-ended general intelligence and ethical AI governance, China’s models are rapidly iterating with a pragmatic, market-driven approach.

However, challenges remain. The long-term sustainability of ultra-low pricing strategies, the constraints of government regulations on AI applications, and the impact of U.S. semiconductor sanctions will all influence China’s AI trajectory. Meanwhile, the competition between Chinese and Western AI firms will continue to shape the industry’s future, driving advancements in efficiency, accessibility, and multimodal capabilities.

As China refines its AI strategy and global markets adapt to its innovations, one thing is clear: the next phase of AI dominance will be defined not just by raw power, but by economic strategy, geopolitical maneuvering, and the ability to deploy AI at scale. Whether China’s AI models can truly rival or surpass their Western counterparts remains to be seen—but they are undeniably changing the game.